Business Interruption, cyber incidents and climate change are considered the top three risks to Australian businesses, with the pandemic outbreak that once topped the previous survey falling to sixth according to an Allianz Global Corporate and Specialty (AGCS) survey.

The AGCS incorporates the views of 2,650 experts in 89 countries and territories, including CEOs, risk managers, brokers, and insurance experts.

Global and regional risk rankings.

The 2022 Allianz Risk Barometer found that cyber perils have been ranked the number one global threat, for the second time in the survey’s history (44% of responses), due to the ever-growing threat of ransomware attacks, data breaches, and IT outages.

“It’s no surprise that cyber is the top Asia Pacific risk for the third consecutive year and second in Australia in light of the high-profile ransomware attacks, combined with problems caused by accelerating digitalisation and remote working,” says Allianz Corporate and Specialty Asia Pacific (APAC) Managing Director, Mark Mitchell.

“Following a year of unprecedented global supply chain distribution, business interruption is a consequence of many of the other risks in the rankings, such as cyber and natural catastrophes, and will be a perennial concern for companies the world over and in the Asia Pacific.”

Business interruption perceived as Australia’s greatest risk to business.

In Australia, business interruption topped the list and marked the fifth consecutive year among the top five rankings (42%). In a year plagued by wide-spread disruption and extended lockdowns, the extent of vulnerabilities in modern supply chains and production networks is becoming more prominent.

Business interruption risks are increasingly becoming an important strategic issue across entire companies. “There is a growing willingness among top management to bring more transparency to supply chains with organisations investing in tools and working with data to better understand the risks and create inventories, redundancies, and contingency plans for business continuity,” says Maarten van der Zwaag, AGCS Global Head of Property Risk Consulting.

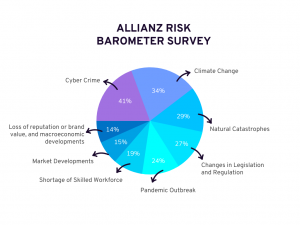

Additionally, the Barometer concluded that natural catastrophes ranked third (25%), up from sixth in 2021, and climate change climbed to its highest-ever ranking of sixth (17%, up from ninth), while pandemic outbreaks dropped to fourth (22%).

Mitchell says that while the pandemic has dropped, the implications of COVID-19 still have lasting ramifications on supply chains throughout Australia.

“This is one of the reasons why business interruption tops the list of risks of 2022 in Australia and is a close second globally,” Mitchell says.

He says that business interruption would be expected to worsen if further government-mandated lockdowns continued.

“While these are not expected in response to the Omicron variant, this could occur if a new, more virulent variant emerged in 2022,” Mitchell continues. “That said, the impact Omicron is having on the workforce and supply chains suggests that business disruption, if not interruption, will be an ongoing issue for some months, and possibly longer depending on the combined impact of COVID and the expected return of a traditional winter influenza season, as is currently occurring in the northern hemisphere.”

Rounding out the top ten risks for businesses list was shortage of skilled workforce (19%), market developments (15%), loss of reputation or brand value and macroeconomic developments (14%) each.